In a nutshell

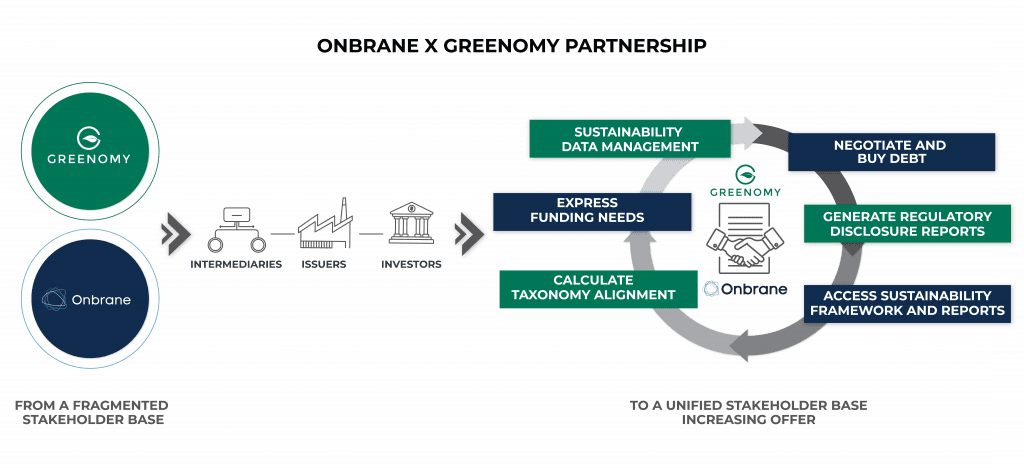

Independently, both of these startups create value by providing digital solutions that create process efficiencies and build sustainability synergies across different stakeholder groups.

Onbrane simplifies the debt financing process for issuers, intermediaries and investors while Greenomy streamlines the process for performing Sustainability analytics and regulatory disclosure for corporates, investors and lenders.

Together, they create synergistic value by delivering complementary solution components to a single objective for a common base of market Stakeholders: deliver an efficient service that provides reliable, high quality information to enable informed decision making.

Who are Greenomy and Onbrane ?

Greenomy

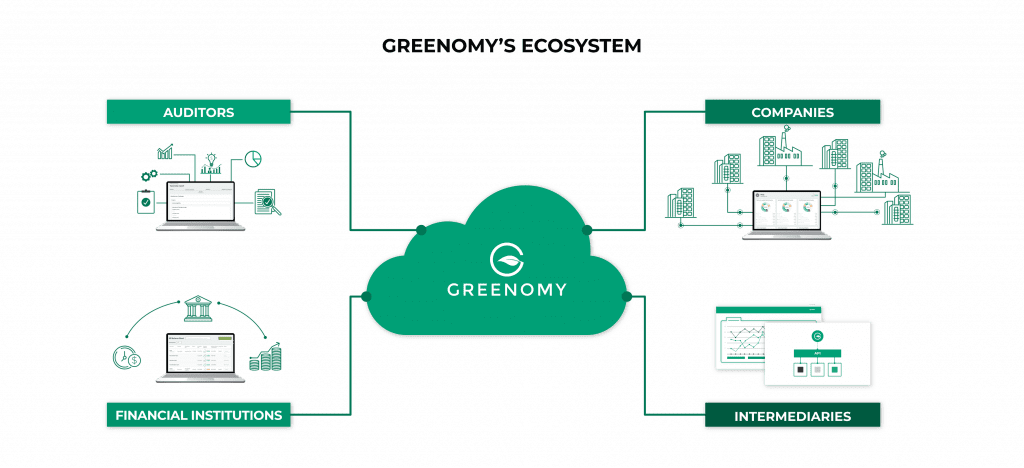

Greenomy is an award-winning regtech SaaS enabling companies, debt issuers, lenders and investors to comply with the new EU Sustainable Finance legislation package (EU Taxonomy/SFDR/NFRD/CSRD) then exceed regulatory requirements by leveraging data management and digital tools to identify, prioritise and achieve quantifiable sustainable impact results.

This SaaS platform is a sustainability management ecosystem that creates value through untapped synergies in processes and information integration between previously disconnected groups of sustainability stakeholders.

Onbrane

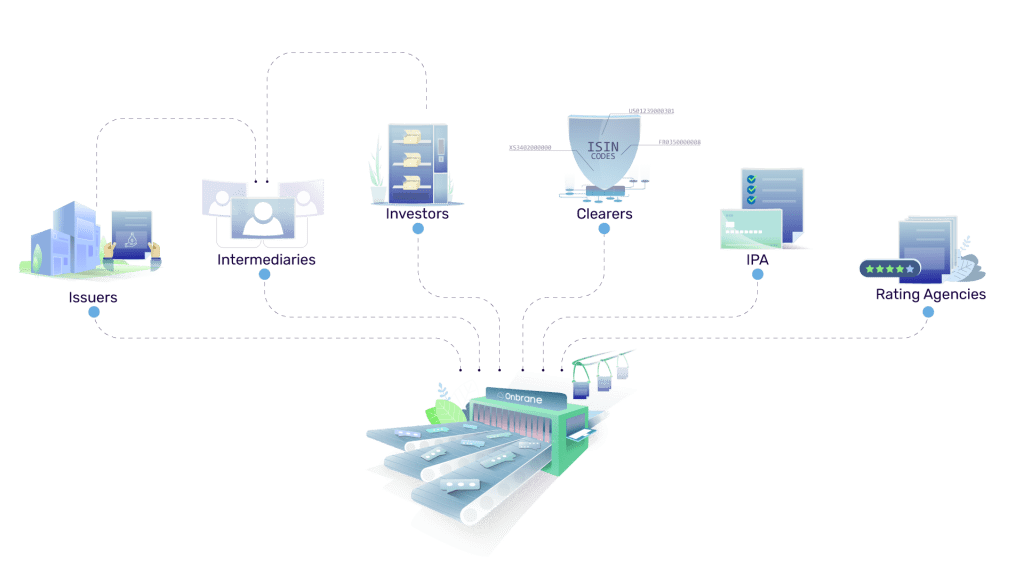

Onbrane is a fast-growing SaaS fintech that helps issuers, intermediaries and investors simplify their negotiation, issuance and investment processes in the primary debt markets through a multi-product, multi-currency OTC platform.

This Saas platform is a cutting-edge marketplace for various short-term and medium-term debt markets that creates value through diversified debt offerings with sustainable debts and greater liquidity and process efficiency for all market participants.

Onbrane’s ecosystem

What is our shared vision of the debt markets ?

We have been cooperating since the Climate Finance Day in November 2020. Our teams share the same vision of the market :

- Sustainability in the debt markets is becoming the new standard. The rise of sustainability labels and standards have become widespread and players must adopt best practices in the market.

- But there is a lack of efficiency, communication and integration between all players in the global debt market. Digitalization is necessary to bring all stakeholders in one place and work efficiently together.

- Finally, a lot of resources and time will be required to comply with new ESG requirements at the EU and national level such as EU Taxonomy, SFDR and green bond standards. These works could be greatly simplified through digital platforms.

- The future of sustainable debt markets depends on the collaboration of independent stakeholder groups to provide effective, reliable, and high-quality information for informed decision-making that support sustainability.

What are the industry’s pain points we are working on ?

Today, most market participants rely on manual processes to ensure access to capital and money markets. No automated and systematic solution is available today to raise funds easily and efficiently in a single place.

Moreover, sustainability standards are constantly evolving and will be applicable to companies and financial institutions. This underlines the lack of sustainability expertise and compliance costs to create the data required by the regulatory standards.

The lack of communication is another major industry challenge to ensure access to capital. Multiple stakeholders and additional processes will be required, either to negotiate funding needs or to execute sustainability requirements

How do our solutions connect and add value to the market players?

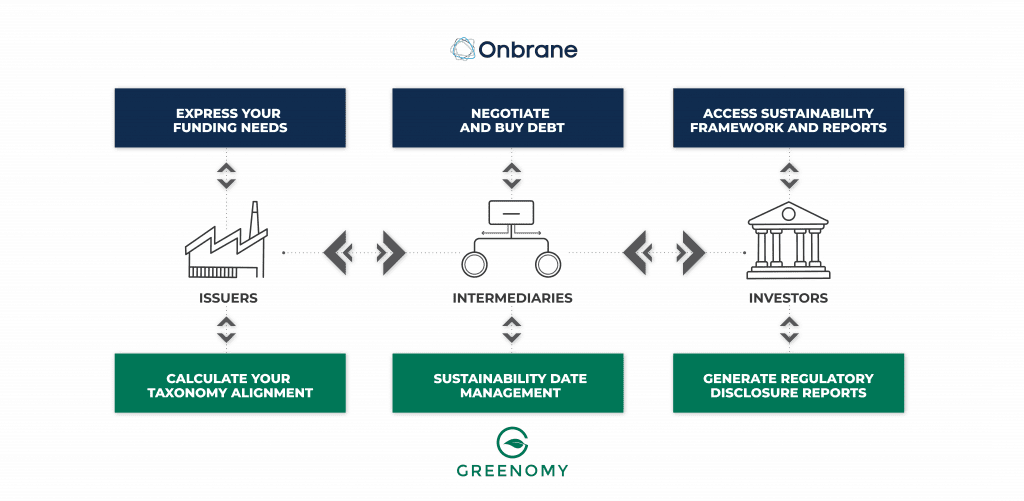

We are two independent solutions attacking the same objective from different angles : enabling better access to debt markets.

- Onbrane brings a one-stop tailored platform to debt financing, offering comfort, efficiency and compliance while saving time and money for issuers, intermediaries and investors.

- Greenomy brings certified taxonomy alignment to debt financing, increasing confidence of investors in underlying from sustainability perspective (E&G), enabling both issuer and investor compliance and lowering cost of capital for issuers.

The best way to present our solutions is to give you some practical use cases between our 2 digital solutions :

- An issuer that raises debt financing on Onbrane will be able to perform activity screening on Greenomy and calculate EU taxonomy alignment with verification from a qualified third party in order to be considered for investment by institutional investors. Thus, he will improve his efficiency to attract funding demand (lowering funding costs) by sharing ESG performance with their counterparts on Onbrane.

- An investor that has a fund portfolio on Onbrane will be able to ask and execute Taxonomy screening for his portfolio on Greenomy. Thus, he will be able to proactively manage the sustainability impacts of his portfolio and generate automated regulatory disclosure reports.

- An intermediary that has access to the ESG data points of all issuers on Greenomy will be able to efficiently search for specific assets and purchase these debt securities on Onbrane. Thus, he will support the financing needs of taxonomy-aligned companies.

Together, the two platforms can expand the universe of investors and issuers covered by an intermediary, interlinking supply on one platform with demand on the other.

Our solutions are designed to complement each other and will be connected through an API and a widget. This enables data to be seamlessly transferred from one platform to the other with no effort or time lost.

What do you think the next steps should be ?

We believe this is an exciting and innovative development in the industry. Our solutions address complementary needs for similar market participants.

We’d love to hear from you to sharpen our vision. Contact us to discuss with one of our experts, discover our solutions and run a trial in your organisation

This article was co-written by Denis Noonan from Greenomy