Primary Debt Market

Fabric

Onbrane produces innovative technology-based platforms for the Debt Market. We bring you efficiency and reliability while respecting current user codes and neutrality.

We love debt

But only on our platform

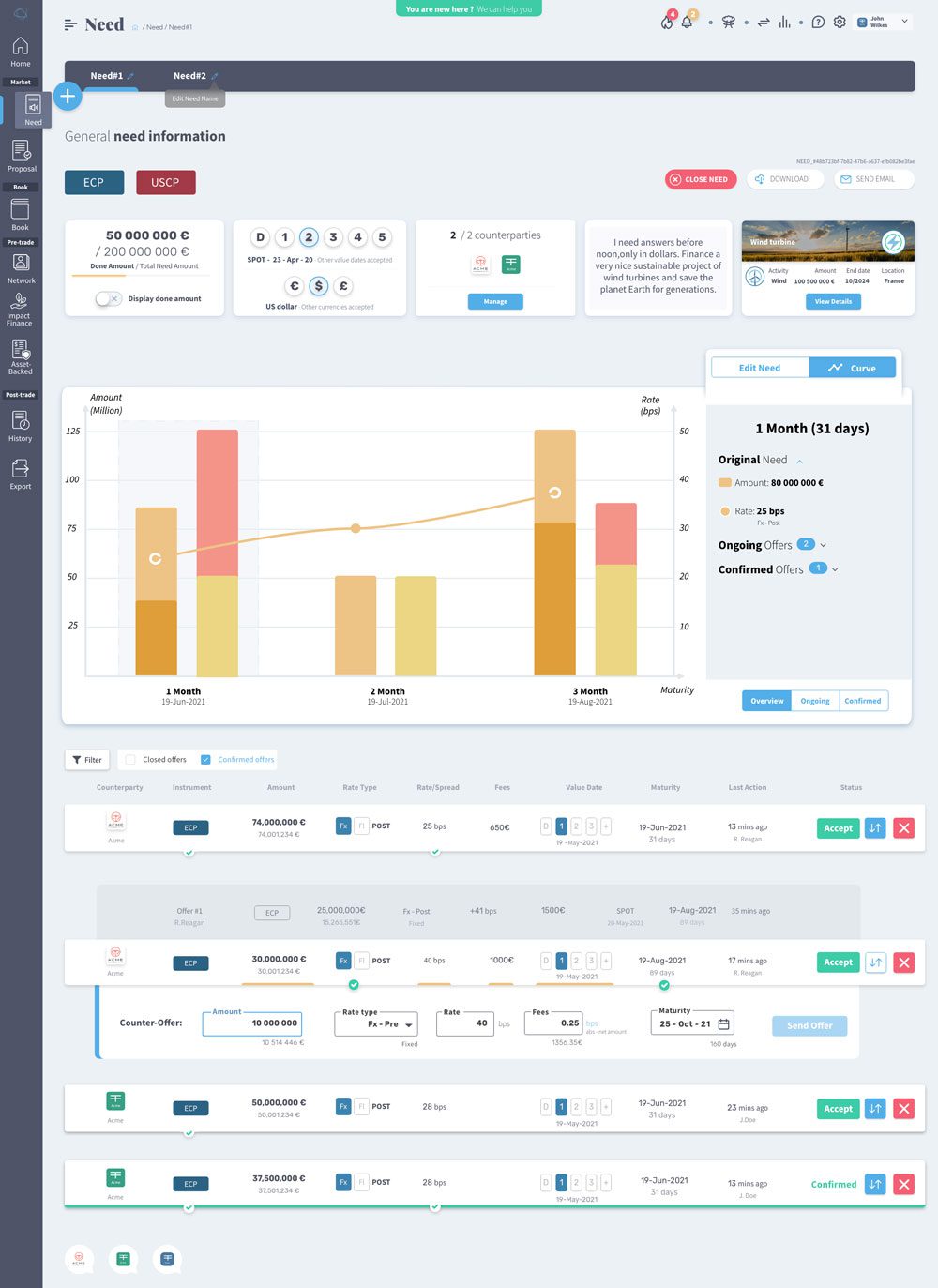

A unique platform for the creation and negotiation of debt products. Understand our platform in 5 points :

01.We cover the main debt needs of corporates, public and financial institutions

02. With standardized or semi standardized debt products

Commercials papers, medium-term notes … we let you choose the products of your choice but remain convinced that simplicity is the key to efficiency.

03. On a cutting-edge platform through every step of the process

We digitalize the processes from the presentation of a debt project to the creation of the product. You keep control and gain efficiency.

04. For and connected to all actors of the debt ecosystem

Our platform does not replace any market experts but allows a better interaction between them. Issuers, dealers, brokers, investors, clearers, paying agents and custodians find added value on Onbrane.

05. Focused on the current pain points, but ready for the technologies of tomorrow.

Our platform meets the daily needs of the industry. But we work, educate and create partnerships on the future of finance. We support decentralized technologies and deep data management without creating a counterproductive revolution.

Testimonies

Impressions of our users

The Company

Who we are

Onbrane was born 3 years ago, at a meeting of people that loved technology and a large issuer that wanted a new way to negotiate and issue Commercial Paper.

- We are a technology provider. We produce platforms for the Debt Market based on innovative technologies, bringing efficiency and reliability while respecting current user codes and neutrality.

- We've created a multi-product, multi-currency OTC platform, built with the market community - for Issuers, Dealers/Brokers and Investors.

- We are a neutral actor, we're not an issuer, an intermediary nor an investor. There is no conflict of interest between the market and us.

Join us

We are looking for talents

Our stories

A deep dive in our minds, maybe soon on Netflix

Meet Olivier Guelly, New Head of Sales at Onbrane

Olivier Guelly – better known as “Oli” to friends and...

Interview: Pascal Lauffer, Onbrane CEO, on AI launch, clients, CMU and big plans for 2025

FinMag.fr recently interviewed our CEO and Co-founder, Pascal Lauffer, about...

Philippe Aymerich, former Deputy CEO of Societe Generale, Joins Onbrane’s Board of Directors

Paris, March 5, 2025 – Onbrane is proud to welcome...

Presentation on “Leading the Money Market Digitalization” from Pascal Lauffer, CEO Onbrane – 24-25 September Meeting Summary by EMMEC

Last week Pascal Lauffer, CEO at Onbrane, was invited to...

Key Takeaways from the European Commission Roundtable on the CP/CD Markets by Pascal Lauffer

At the European Commission roundtable on September 11, 2024, industry...

Launching 1MM, an industry-wide initiative to achieve Europe CMU

Dear primary debt market community, Onbrane is launching 1MM (for...

You need insight about our markets ? Use our free data visualisations

A gift for you, and we have better ones for our clients

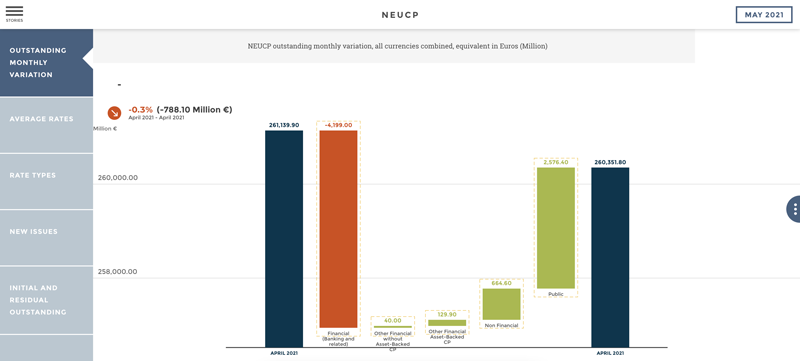

Short & Medium terms Debt

Check out our monthly updated dataviz with all the official data provided by the Banque de France on the NEUCP and NEUMTN markets and by the FED on USCP market.

Find out the trends in these markets. Navigate through the charts to have a quick overview of the ecosystem or to make a strong analysis of the impacts of the restart of the activity on the Commercial Papers markets!

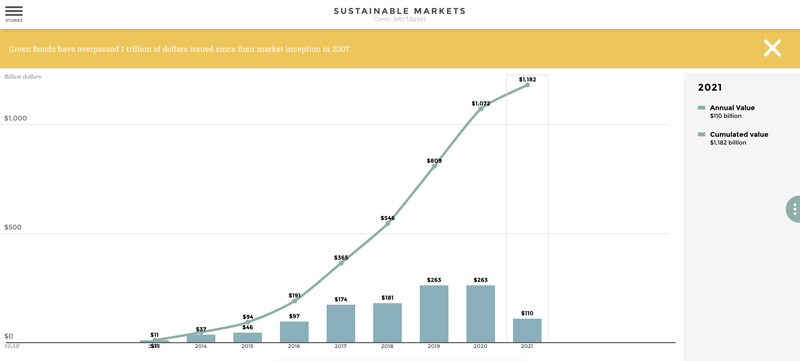

Sustainable Debt markets

Check out our monthly updated dataviz with sustainable debt market data on our website ranging from green, social and sustainable to sustainability linked debts.

Watch the rise of sustainable finance in the capital debt markets. Navigate easily through the charts to get a quick overview of the ecosystem or to do a solid analysis of the impacts and allocation made by sustainable debt markets.